How does grantmaker CEO compensation compare with grantmaking?

Candid

NOVEMBER 27, 2024

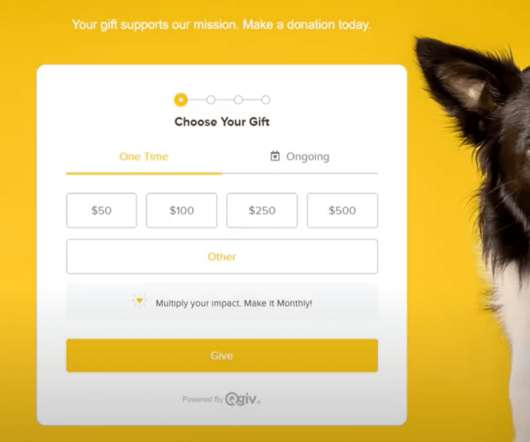

i For every grant dollar awarded, CEOs are paid a median 4¢ At nearly all the private foundations that responded to the COF survey, the ratio of CEO cash compensation to annual grantmaking was very small. In 2023, the median ratio for our sample was 0.04, meaning that for every $1 the organization granted, the CEO received compensation of 4¢.

Let's personalize your content