Digging Into Data: 7 Key Metrics to Track + Common Data Questions

Allegiance Group

JUNE 4, 2024

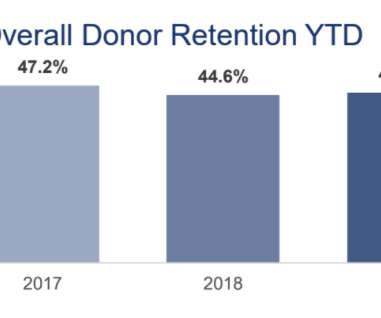

To truly understand the health of your organization, there are seven key metrics you should track in your database: Year-on-year revenue Donor file growth Donor retention Gifts per donor Average gift Revenue per donor Cost to acquire Data can be overwhelming. Let’s look at some common questions we often get regarding data.

Let's personalize your content