How Your Organization’s Charitable Arm Can Manage Restricted Funds to Grow Your Stewardship

sgEngage

JUNE 16, 2022

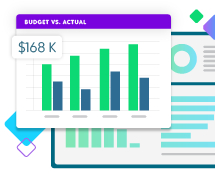

Without clear insight into the available funds earmarked for charitable arms of larger organizations, it’s difficult to see the complete picture of their financial standing. The Problem with Managing Donor Restricted Funds. Financial Stewardship Through Restricted Fund Accounting Software.

Let's personalize your content